Pick a personalised approach to recurring transactions

Business owners often ask us to explain the benefits of using a System Operator (SO), such as BankTech, to collect and make recurring payments. While people generally think that cutting out the middle man saves both time and money, it is our experience that using a non-bank intermediary to handle payment instructions on your behalf can greatly improve collections success rate, customer experience and operational efficiency.

Here are our top FAQs that simplify the differences between bank and non-bank services within the collections framework.

1. What are the main pain points experienced by companies when setting up recurring payments with a bank?

Retail banks deal with high-volume and -value transactions for both collections and payments, which means that their onboarding processes may not suit smaller businesses from an operational or cost perspective. Client mandates are typically uploaded using host-to-host integration and file sharing, rather than through a front-end interface. This host-to-host integration requires significant resources and IT infrastructure, which might make it inaccessible for smaller companies without senior banking relationships or big IT support teams.

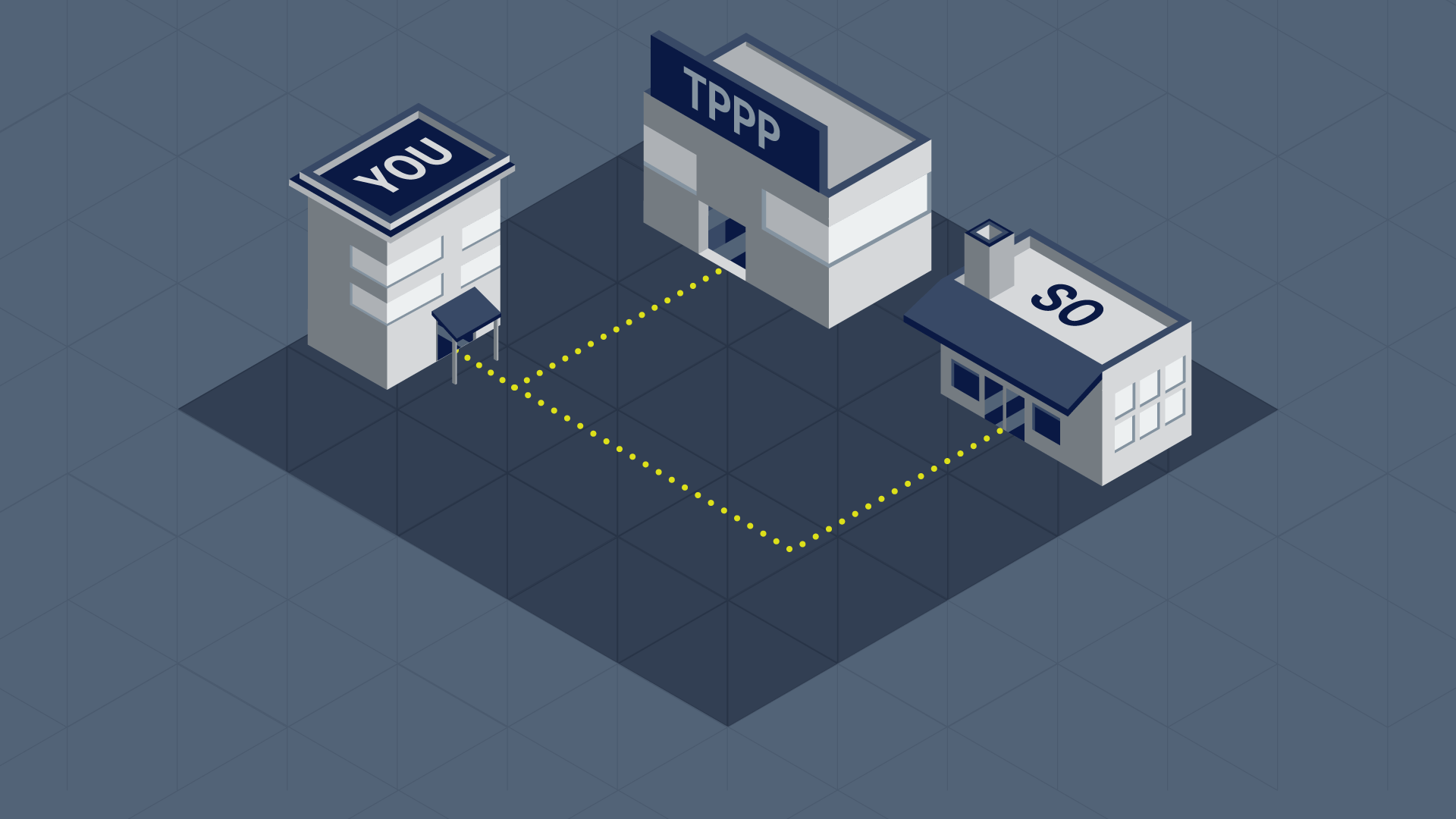

2. How is this onboarding process different with a System Operator?

A System Operator (SO) acts as the intermediary between the banking systems and the business. As an SO is already integrated with the bank and third-party platforms, it is far less onerous for businesses to integrate with one. An SO such as BankTech is also integrated with multiple banks, which means a customer gets the benefit of being multi-banked, but still only requires one integration with BankTech.

When uploading mandates, BankTech meets clients where they are. For example, clients with large transaction books may choose a full integration of their ERP or product system, but clients with smaller books may prefer to upload mandates manually, or via spreadsheets.

3. What other benefits might a business receive through an SO that are not generally accessible through the bank?

Not all SOs are cut from the same cloth! Therefore, it is vital to partner with an SO that can continue to add value to your business as you grow. Tangible benefits offered by BankTech lie within segmentation. When working directly with a bank, the process is very cut and dry – the bank collects and reconciles payments, but there are no optimisation measures in place to best manage the balance between cost efficiency and collections success rate. By contrast, using the tools within BankTech’s Collections engine, businesses can use machine-learned data to better understand their customer behaviour and then apply different rules to different segments. For example, customers with good behaviour may not warrant the extra spend on expensive instruments such as payment tracking, whereas a more aggressive approach might be chosen for new customers whose behaviour is still unknown.

Extra value is offered in an SO’s 1-to-1 automated reconciliation process, which allows businesses to track and record the success of each individual payment, e.g. which payments were processed by the bank, which failed due to lack of funds and which were not found.

The BankTech Console further offers businesses a host of plug-and-play add-ons to enhance their service offering. These include:

- An e-commerce plugin for recurring subscriptions, which allows customers to purchase a subscription online via debit order (or card)

- Console-initiated subscription that enables a business to upload members, subscribers or similar, onto a dedicated subscriptions page

- Self-service WhatsApp bot that allows a sales consultant to send an SMS or email with link to T's & C's and opt-in to customers on WhatsApp.

4. This all sounds expensive! Will it cost a lot more to work with an SO?

To collect payments on your behalf, an SO runs payment instructions on your own account, enhancing these instructions so that they are easier and clearer to interpret. BankTech charges you a flat processing fee per transaction, sold in a bundle. Any bank fees remain separate and are charged to you directly by the bank.

With regards to the plug-and-play tools described, many are bolt-on services that can be initiated as and when your business is ready to scale up. This helps you to keep your operational costs to a minimum.

5. How do we get started?

To get started, get in touch to request a demo of our payment solutions or to discuss your requirements with our team.